Who Should Be Covered

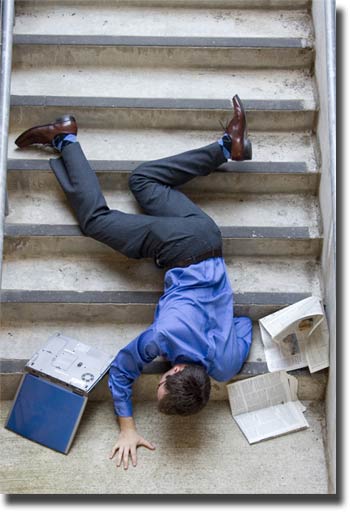

Personal Accident Insurance provides relatively inexpensive cover payable if you sustain any injury or death as a direct result of an accident

Death, Disablement or Medical Expenses as a direct resdult of exposure of an injured person to extreme or violent natural climatic conditions (tsunami, volcanic eruption, cyclone, etc) shall be deemed to have been caused by accidental bodily injury

| Benefits | Payable |

|---|---|

| Death | 100% |

| Loss of any hand & foot, arm & leg or any combination thereof | 100% |

| Permanent Total Disablement | 100% |

| Permanent Total Organ Paralysis | 100% |

| Total loss of sight in one eye | 100% |

| Total loss of hearing in both ears | 80% |

| Total loss of hearing in one ear | 20% |

| Loss of thumb | 25% |

| Loss of index finger | 15% |

| Loss of any other finger | 8% |

Exclusions: If you have taken intoxicating liquor or drugs (other than prescription). Or engaged in any of the following sports:

- • Any sport as a professional

- • Any speed contest

- • Unarmed combat or martial art

- • Mountaineering, rock climbing, pot-holing

- • Sub-aquatic activity using scuba equipment

- • Aviation except on a regular airline

- • Parachuting, hang-gliding, springboard diving

- • Horse riding, snow & water skiing

- • Rugby or Association football, triathalon

- • Willful exposure to needless peril except to save human life